FARMINGTON – The Board of Selectmen voted unanimously to approve a 10-year tax increment financing agreement for a $4 million memory care facility Tuesday evening. That agreement will require voter support at a special town meeting, tentatively scheduled for July 26.

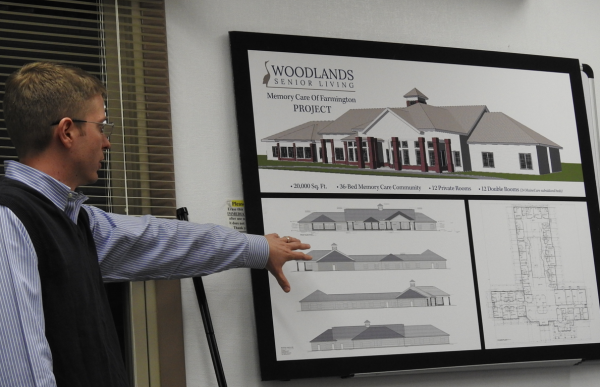

Lon and Matthew Walters, co-owners of the Woodlands Senior Living company, have proposed to build a 36-bed, 20,000 square foot facility specializing in the care of those with Alzheimer’s and other memory impairments. The facility, located off the Knowlton Corner Road, would be the 13th operated by the company.

The T-shaped center would include 12 private rooms and 12 double rooms with 24 MaineCare subsidized beds available, a central courtyard and central common areas such as an activity room, kitchen, TV room and reading room. The center is expected to employ 32 people.

The Walters previously proposed a short-term TIF agreement with the town to help defray the front-end costs of construction. The TIF would return all taxable income of new valuation to the developer through a credit enhancement agreement.

The agreement would also allow the property to remain valued at the undeveloped amount as far as the state is concerned and therefore not factor into the town’s state valuation. Because the development’s state valuation would not show an increase, the state’s aid to education and municipal sharing are not reduced and Farmington’s share of the county assessment would not be increased as a result of the new value.

The board has discussed the issue in executive session and visited a Woodlands facility in Lewiston. Tuesday, selectmen said they came away from that visit with a positive impression of the company. Selectmen called Woodlands a “Class A organization,” based on their dealings thus far with the town.

“We’re looking into the future with this,” Selectman Michael Fogg said, terming the project as a “big boost” that provided much needed services for the area.

According to the developers, there are approximately 29,000 people suffering from dementia in the state with about 1,000 in Franklin County.

The TIF agreement would be for 10 years, Town Manager Richard Davis noted. The agreement would be modified in the advent of additional phases of the project, something that could occur within the first few years.

TIF agreements of this nature must be approved by residents at a special town meeting. That meeting will likely be held on July 26, although warrants will not be signed until the July 12 selectman meeting.

“The Walters previously proposed a short-term TIF agreement with the town to help defray the front-end costs of construction. The TIF would return the taxable income of new valuation to the developer through a credit enhancement agreement.”

Why should voters defray the cost of construction of a private for profit business if voters do not feel that they can fund the local school systems?

I bet the income of the developers who own 12 other facilities is higher than the average business owner in the area. After all the citizenry have been up in arms with the salaries of school administrators who labor in a non profit endeavor for the children of the area, why corporate welfare for wealthy developers?

Without more details I have no opinion as to whether its a good idea or not, but to be clear this is not “corporate welfare”. Welfare, which is entirely appropriate at times, is giving someone money that is not theirs. The above proposal is not giving them someone else’s money, its taking less of their money. That’s a pretty significant difference. Allowing a new business (which should bring new jobs and services to the area) to keep a higher percentage of what they earn for a period of time to help it to establish itself sounds like it has some merit.

Lots of details, but something still doesn’t sound right.

They want assistance, rather than being fiscally responsible and using their own funds? They’re only going to employ 32 people for a possible 36 patients? That ratio is a fantasy when you consider the high needs of the patients, front-desk staff, access and administrative staff, kitchen, house-keeping, and facilities’ staff.

I hope Farmington does some more research because there are aspects to this proposal that just don’t sound right.

Giving people back taxes that they would otherwise owe is the same as giving them something that is not theirs.

They owe taxes- the taxes owed are not their property. It is the property of all the tax payers.

Hypothetically if I want to build a home in Farmington- Why can’t I get my property tax back to defray the cost of building the home? I will bring benefit to the community- buy building materials, employ local tradesmen, shop locally, add to the tax base to relieve the burden of other citizens.

I just find it hypocritical that property tax payers are going nuts over the school budget and pounding on the school board with multiple revisions/budgets while this deal sails through with apparently so little debate or scrutiny.

TIF’S are nothing more than corporate welfare. If one entity gets a tax break someone else pays. Big brother wants his money regardless so ‘Joe Taxpayer’ pays. Why can’t people figure this one out?

So…a proposed TIF on a 4 million dollar building….How much? 25% of taxes? 50 % of taxes? 100% of taxes? About how many tax dollars will be returned to the developers/owners? A few details would be great to have before the town meeting? Selectmen: What did you vote on? Are the details available for review anywhere?

Thank you and have a safe 4th of July weekend!

As proposed, the TIF would return the taxable income of all new valuation for 10 years.

Admin: Thank you for the details.

As a person who has watched too many of my friends have to deal with the troubling choices of putting a loved one into a care center I for one will be happy to have this new choice here close to home. The idea of the TIF not only will bring a NEW much needed service but new jobs and NO increase in State valuation thus NO decrease in state aid to local government and or school too for the length of time the TIF stands, so even if they pay only 10 percent of the property tax vale to the town in those years it would still be a win for the town.